Executive Summary

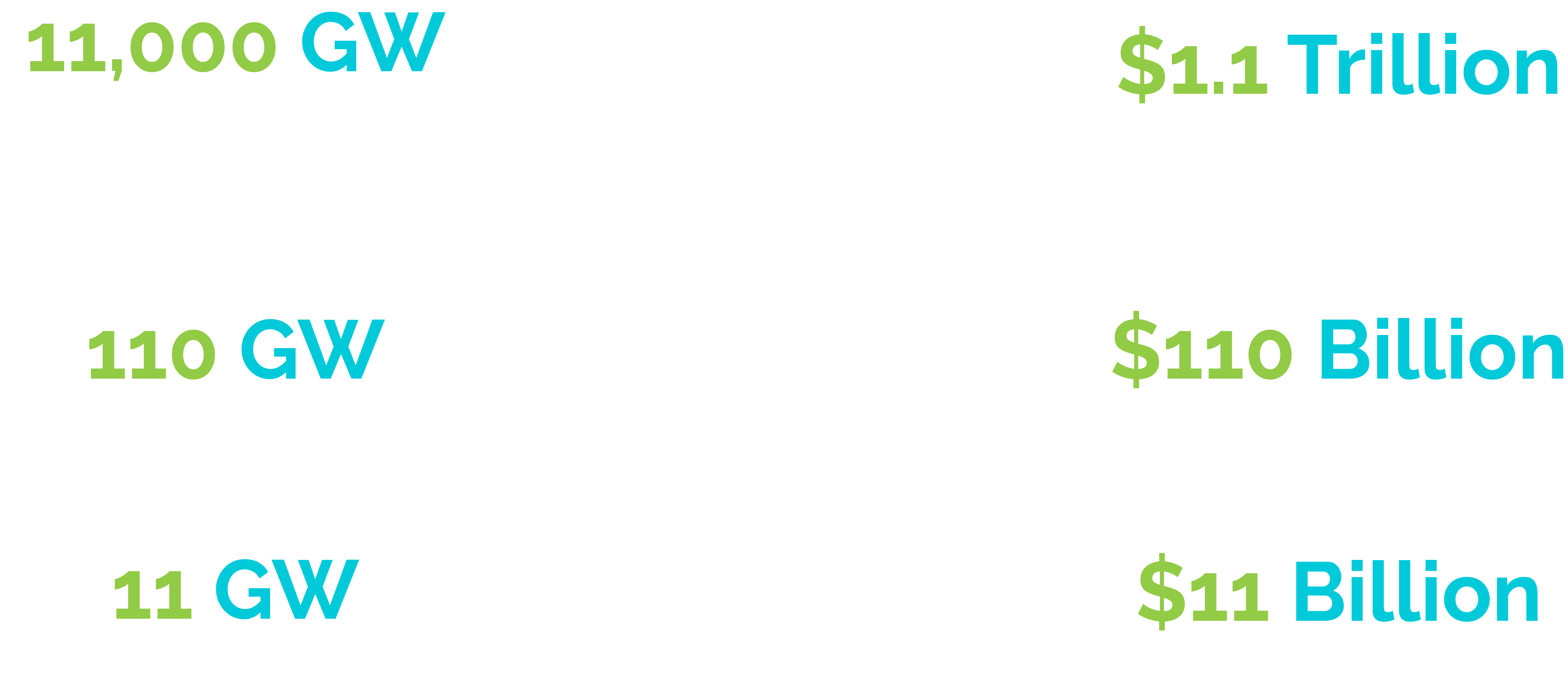

An investment opportunity with the Green Energy Capital Advisors, initiated following the COP28 endorsement by 130 governments, including the European Union. The ambitious goal is to triple the world’s installed renewable energy capacity to at least 11,000 GW by 2030.

Context

At COP28, the majority of national governments and organisations committed to tackling climate change. A swift decarbonization of the energy system is crucial for keeping the goal of 1.5C within reach. This requires accelerating clean energy transition both from the demand and supply side.

To accelerate the energy transition, the COP28 presidency spearheaded the launch of the ‘Global Renewables and Energy Efficiency Pledge’. The endorsement consists of 130 governments including the European Union. The signatories have committed to work together to triple the worlds installed renewable energy generation capacity to at least 11,000 GW by 2030.

Our Role

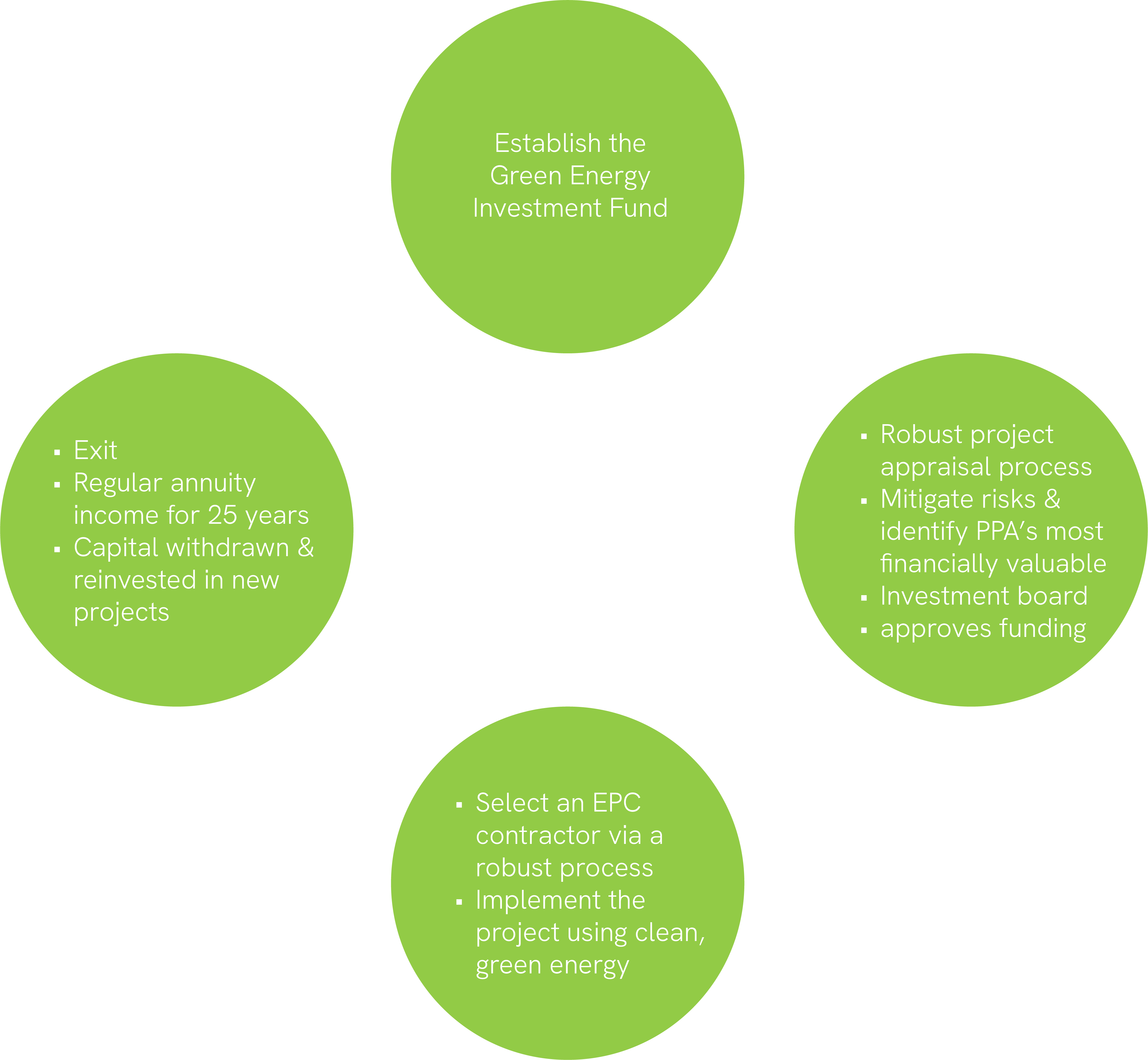

At the Green Energy Capital Advisors, we access global public and private sector PPAs, ready for deployment with EPC contractors. Our central capital pool enables scalable, continuous investment and returns with controlled risk, eliminating the need for individual project lenders.

The fund will own PPAs for Solar Parks and Battery Energy Storage Solutions (BESS), generating regular income streams. It may choose to exit after 2-3 years, when returns are higher, maximizing investor gains. Ensuring optimal profitability and flexibility for investors, allowing both steady income and significant exit opportunities.

The expected returns are compelling, with projects de-risked quickly and generating trail income. There are opportunities to exit at the de-risk stage for substantial gains. Our compiled expertise provides a full turnkey solution, replicated across multiple project cycles, thereby further mitigating risk.

Announcement

Following the pivotal discussions at COP28 in Dubai, the incoming UK Government has reinforced its commitment to achieving net zero emissions by 2050. As part of this ambitious agenda, the Government has promised to deliver a zero-carbon electricity system by 2030. This will require significant investment, and the government is actively encouraging the private sector to participate.

Following the pivotal discussions at COP28 in Dubai, the incoming UK Government has reinforced its commitment to achieving net zero emissions by 2050. As part of this ambitious agenda, the Government has promised to deliver a zero-carbon electricity system by 2030. This will require significant investment, and the government is actively encouraging the private sector to participate.

In response to this call to action, a consortium of experts from various sectors including public, private, charitable, and financial—have come together to establish Green Energy Capitol Advisors Ltd UK (GECA). GECA’s mission is to accelerate the UK’s transition to renewable energy by setting up a billion-pound fund dedicated to this cause. The initiative has already gained significant momentum, beginning with £100 million in seed funding for its inaugural 260MW Battery Energy Storage Solution (BESS) Project in the UK.

GECA is also pleased to announce its strategic partnership with Apex Investments, an Abu Dhabi-based investment fund. This partnership marks a major milestone in international collaboration on renewable energy. A public Memorandum of Understanding (MoU) signing ceremony will take place in the UAE in mid-September 2024, symbolizing the commitment of both parties to this vital cause.

The partnership will be formally launched in November 2024, with the unveiling of the joint fund’s first renewable energy project. This initiative aims to contribute significantly to the UK’s Grid storage capacity and management of renewable energy targets.

The partnership will be formally launched in November 2024, with the unveiling of the joint fund’s first renewable energy project. This initiative aims to contribute significantly to the UK’s Grid storage capacity and management of renewable energy targets.

Mr. Iftikhar Ali, Co-Founder, CEO, and Chief Investment Officer of GECA, stated, “This marks the beginning of a long-term partnership between GECA and Apex Investments to drive forward the net zero agenda. Together, we aim to achieve 11GW of renewable energy capacity by 2030 in the UK. We are committed to supporting both the UK Government and the international community in meeting their climate change and renewable energy objectives. If successful, this partnership will represent a significant milestone in the global challenge to combat climate change and achieve net zero emissions.”

Mr. Ahmed Amar, Co-Founder and CEO of Apex Investments, added, “I am thrilled to announce our partnership with GECA, which marks a pivotal step towards transforming the renewable energy landscape in the UK and, ultimately, on a global scale. We eagerly anticipate collaborating with governments and institutions to leverage our funding and cutting-edge green technologies, with a particular focus on advancing Battery Energy Storage Solutions. Together, we are poised to drive significant progress in the fight against climate change and the pursuit of a sustainable future.”

Leadership Profile

IFTIKHAR ALI

CO – FOUNDER & CHIEF INVESTMENT OFFICER

Iftikhar Ali is a financial markets professional with over 30 years of experience, during which he has accumulated an in-depth knowledge of emerging market debt, including trading, investing, and origination.

During his career, he has run trading and proprietary credit businesses at Citibank and BAML, managed portfolios at several large hedge funds, and was CIO at a fund he started, Rhodium Capital, which invested in global credit. He was also head of emerging markets credit trading at BNPP.

For the last 4 years he has served as CEO of African Conservation and Development Group leading a large-scale development programme in Southern Gabon.

EDWARD MARK THOMAS

NON-EXECUTIVE DIRECTOR

Founder of Cranborne Chase, Edward has a 31 year career in Financial services, where he held senior positions with major investment banks, including Credit Suisse First Boston, Citigroup, UBS and Nomura. Responsible for debt trading and origination across a variety of markets.

In 2012 he moved to Zurich to take on the role of Head of Fixed Income Investment at Quantum Global Investment Management managing Fixed Income and direct lending portfolios with an AUM of over $3bn.

Currently CIO of Cranbourne Chase Asset Finance. Specialist private debt originator and investment managers specialising in real

estate and land lending.

Executive Profile

ABID KHAN HUSSAIN

CO – FOUNDER & EXECUTIVE DIRECTOR

A professional 35 year career that has touched every sector; public, private, and charitable. Abid, a law honours graduate, with post graduate studies in Leadership and Management brings a wealth of experience to the table. He doesn’t just manage partnerships; he forges them. Crafting resilient financial and investment models tailor-made for stakeholders.

ZAFAR ANWAR

CO-FOUNDER & EXECUTIVE DIRECTOR

Zafar Anwar is a renowned businessman and philanthropist. He has extensive experience in the real estate and energy sectors. His passion for tackling climate change has attracted him to the Green Energy Capital Advisors.

DAVID STOKES

EXECUTIVE DIRECTOR

A seasoned entrepreneur and businessman who after leaving formal education, joined the family business in Gold wholesale and retail in London’s Hatton Garden. He later became founder and part of the team that developed & commercialised the world’s first biodegradable polymer.

FREDERICK JACOBS

EXECUTIVE DIRECTOR

Frederick Jacobs is a well-known African British businessman. He has extensive business networks and interests in Africa. He has managed and deployed investment funds for various initiatives and gained substantive returns for investors.

Market Opportunity

We are at a crossroad to achieving a historical milestone in tackling the climate control agenda whilst making a healthy profit for our investors. Our strategy is to develop a circular ecosystem that helps create clean green energy to help meet the 11,000 GW renewable energy target set at the COP 28 Conference.

A fund to return healthy profits from renewable energy will act as a catalyst and magnet for future investors to take part in making history by paving the way to decarbonising the world and profiting responsibly.

Innovative Technology

Supercapacitor BESS

Long Life Cycle

50,000

Rapid Charging

Greater Temperature Tolerance

-30 to +60 degrees

Fireproof and Safer Operation

Environment Friendly

High Power Density

Low Maintenance

Cost Efficiency

Anti-Theft

Electronic Management Informatin Systems

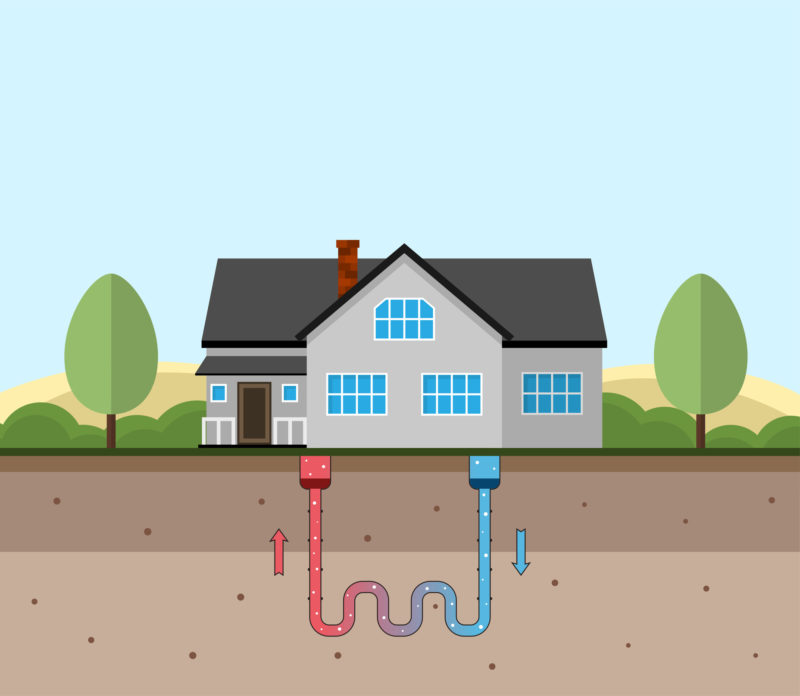

Geothermal Technology

Provision of affordable cooling & heating

Absorbed as part of construction costs

Building is charged during the day through passive energy

Vertical Closed Loop Geo-exchange Retrofit System

Capacity-Integration with Heating and Cooling Split Type Units

Execution Time: 6-8 Weeks

Full turnkey Geothermal With Solar & BESS solution available

Investment Methodology

Once projects are narrowed down or selected for due diligence

Detailed discussions with contractors including site visits

Detailed costing of all hardware

Breakdown of labour cost

Breakdown of logistics and management overhead

Breakdown of maintenance contract and costs

Meeting with off taker or PPA buyer

Full legal review of all agreements

Project DD

Negotiate final contract with EPC

Include penalties and contingencies (substitution etc)

Legal documentation

Design a funding schedule with milestones

Assign complete legal rights of PPA agreement to the fund

Manage billing arrangements, payment collection and frequency

Pricing agreements as part of PPA

Create a PDD for registration with a recognised carbon verifying body

Project Implementation

Draw first funding

Commence the programme

Continuous review of installations

Inspection of sites

Rollout new sites

Monitor billing and collection process

Further funds drawn as milestones reached

Probity & Risk Mitigation

Project Checklist – Due Diligence (Ensuring everything is real)

PQQ – Pre-Qualification Questionnaire – partner’s experience, track record, capacity, insurance, certifications, financial health, risk mitigation, authority to sign PPA rights, optimisation & exit strategy.

KYC – Know Your Client

SOPs – Standard Operating Procedures – Structures, Systems, Policies & Processes, Standing Orders etc.

Project appraisals to include:

Delivery options

Risks and mitigation

Milestones & timelines

Deadlines & penalties

Financial forecasts / actual draw downs

Income vs expenditure

Outputs / outcomes

Forward / succession strategy & Exit

Legal agreements

Accounts & Audit

Carbon Credits

For each project, a PDD (Project Design Document) will be created and registered with one of the verifying bodies such as VCS or Gold Standard.

We intend to register the project at a national level in the country of operation, making Carbon Credits transferable under Article 6 of the Paris Agreement.

All Carbon Credits generated from our projects belong to the Green Energy Capital Advisors.

Corporate Social Responsibility (CSR)

Social corporate responsibility, often called corporate social responsibility (CSR), is when a company cares about more than just making money. It means they think about how their actions affect people and the planet. They try to do things that help society, like being environmentally friendly, treating their employees fairly, and giving back to the community. It’s about businesses being responsible and making positive contributions to the world beyond just their profits.

The Green Energy Capital Advisors will create programmes across Asia, Africa & Europe. The fund will allocate a percentage of it’s profits to provide poverty relief. The various interventions include; food programmes, skills development, women’s empowerment, healthcare provisions, education enhancement to name a few.

Join the Green Energy Capital Advisors: A Unique Opportunity

Be a part of our mission to lead the global charge toward a sustainable future. We are committed to deploying our cutting-edge green energy solutions to decarbonize the world.

What We’re Looking For:

- Invest in Change: We are actively seeking innovative renewable energy projects that we can fund and accelerate their market reach.

- Partner with Us: We’re also on the lookout for dependable partners ready to meet the ambitious targets set by COP28.

For further information you can

contact us on: info@geca.uk

CEO Office: Iftikhar@geca.uk